The Definitive Guide: Top Investment Watches for Men in 2026

In the world of horology, time isn’t just measured; it’s capitalised. As we step into 2026, watch collecting has transcended hobby status to become one of the most stylish hybrid assets on the market: part wearable art, part tangible investment. Whether you’re a seasoned collector or just dipping your toe into the deep end of the secondhand market, these are the trophies worth owning.

The Watches

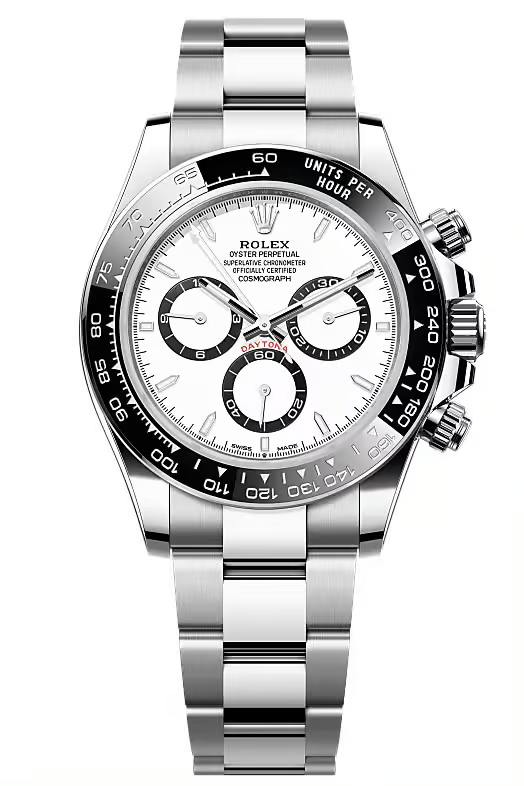

1. Rolex Daytona – The Undisputed Champ

There’s a reason Rolex continues to dominate the investment conversation: unwavering demand, limited supply, and perennial desirability. The Daytona remains the icon of icons, a chronograph legend whose resale values often sit comfortably above retail, even years after purchase.

Why it’s smart: steady appreciation and universal collector appeal.

2. Patek Philippe Nautilus – The Grail Watch

If there’s one name that evokes lust like no other, it’s Patek Philippe Nautilus. Thanks to its scarcity and cult status, certain Nautilus references have seen astonishing market premiums. This isn’t just a watch; it’s a future heirloom.

Collector tip: discontinued or rare dial versions can dramatically increase investment upside.

3. Audemars Piguet Royal Oak – The Avant-Garde Classic

Bold, iconic, and perennially sold out; that’s the Royal Oak in a nutshell. With its instantly recognisable design by Gérald Genta, the Royal Oak continues to be one of the most sought-after pieces in both the primary and secondary markets.

Investment edge: limited production and passionate collector demand fuel strong secondary values.

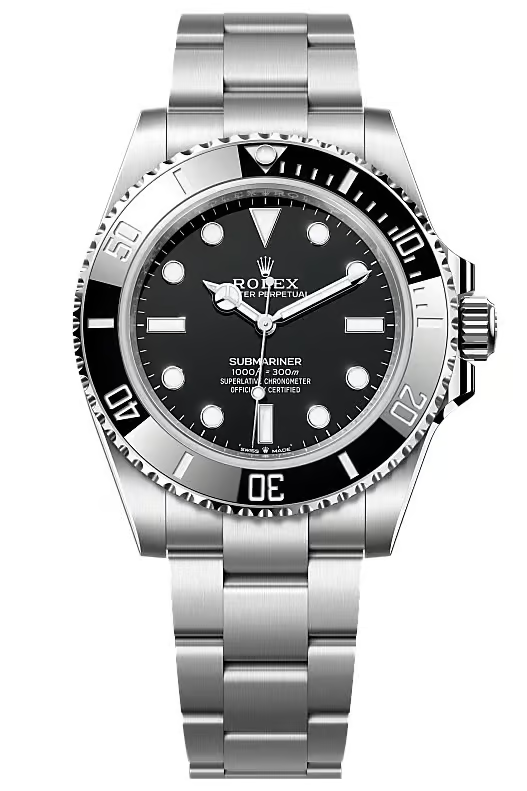

4. Rolex Submariner – The Divers’ Darling

For an investment piece that’s iconic and accessible, few watches match the Submariner. Its timeless profile makes it endlessly wearable, but its scarcity (especially specific references or discontinued colors) keeps resale prices robust.

Style note: a Submariner pairs as seamlessly with sneakers as it does with a tuxedo.

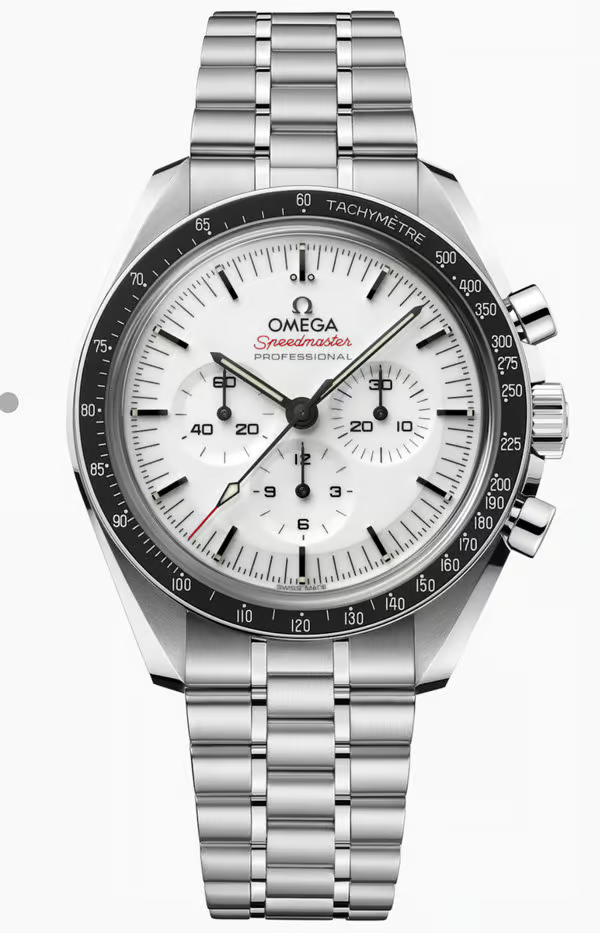

5. Omega Speedmaster “Moonwatch” – Accessible Legacy

If Rolex and Patek are the blue chips, the Omega Speedmaster is the emerging growth story; a historically significant chronograph with steady collector interest and a compelling price point.

Investment bonus: iconic NASA heritage adds narrative value alongside market value.

6. Cartier Santos – The Elegant Long Game

Cartier’s rise in the secondary space has been subtle but undeniable, with the Santos emerging as a surprise favorite among collectors who crave classic design plus resale stability.

Collector appeal: historic geometric silhouette meets growing market interest.

7. Grand Seiko – The Cult Classic with Ascending Value

While not as headline-grabbing as the Swiss majors, Grand Seiko has quietly built a reputation for excellence—and that’s translating into growing collectibility and value retention.

Investment insight: understated craftsmanship that increasingly resonates with enthusiasts.

In Summary

Investing in watches isn’t about chasing meteoric short-term gains; it’s about understanding legacy, scarcity, and desirability. While the market can fluctuate (even blue-chip names aren’t immune), the watches that hold value over time are those with story, heritage, and relentless demand.

Pro tip: buy what you love and wear it with confidence, because a watch that’s enjoyed is more likely to be cherished (and retained) through market cycles.

2026’s most compelling investment watches blend timeless design, brand gravitas, and secondary market strength. Whether you’re drawn to Rolex’s perennial classics, Patek’s lofty rarities, or Omega’s accessible icons, there’s a piece waiting to become a cornerstone of your collection; and a future asset in its own right.